In this

Best ETFs Australia review, I’ll take you through my

top 10 ASX ETFs for 2021 covering technology,

diversified ETFs, defensive ETFs, and

ethical ETFs.

In no particular order, here they are:

VDHG ETF

The

Vanguard Diversified High Growth Index ETF (

ASX: VDHG) is perhaps my favourite diversified ETF on the ASX. VDHG is a ‘fund-of-funds’, meaning it holds other ETFs and managed funds rather than individual shares.

For a low annual management fee VDHG provides exposure to seven Vanguard wholesale and retail funds, including the

Vanguard Australian Shares Index Fund (Wholesale), Vanguard International Shares Index Fund (Wholesale), and the

Vanguard Global Aggregate Bond Index Fund (Hedged).

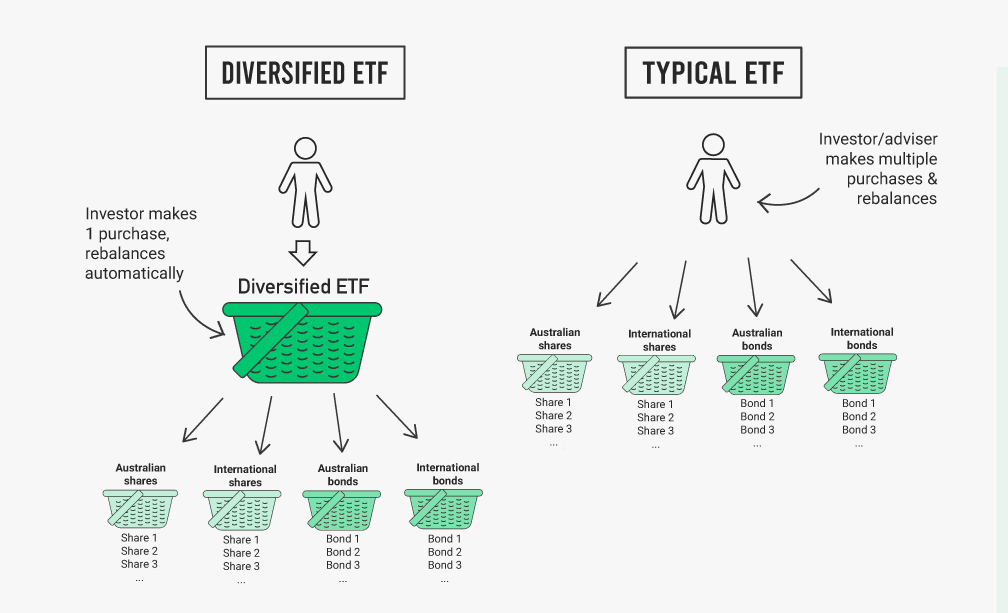

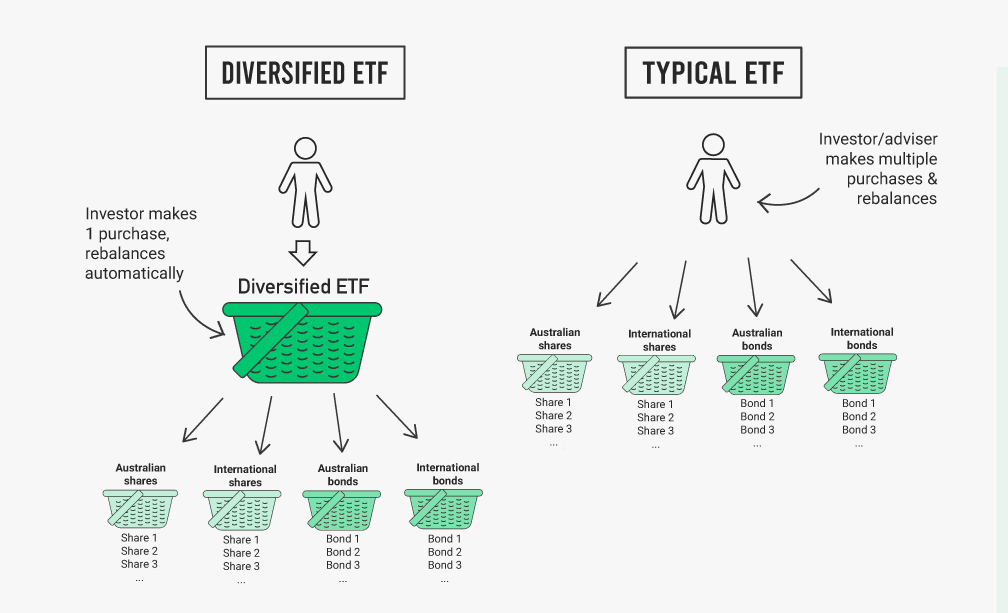

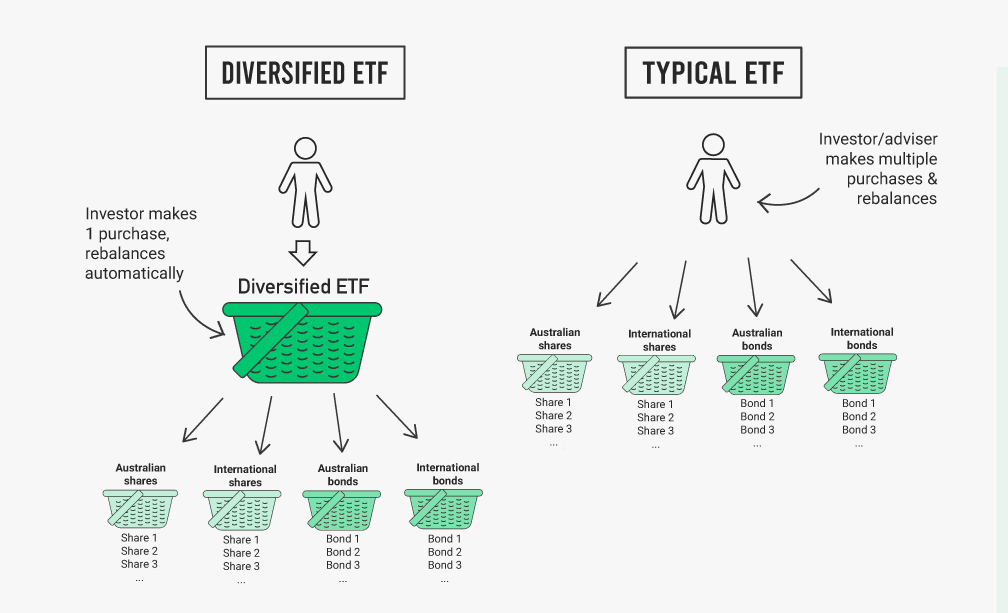

VDHG is a high growth portfolio with 90% growth assets (like Australian and international shares) and 10% defensive assets (like bonds and fixed interest assets). Diversified ETFs are possibly the easiest way to start investing as one purchase gives you access to a fully diversified portfolio, and you don’t even need to worry about rebalancing as it’s done for you within the ETF.

ACDC ETF

The

ETFS Battery Tech & Lithium ETF (

ASX: ACDC) is a thematic ETF targeting the battery technology and energy storage megatrend. ACDC follows the

Solactive Battery Value-Chain Index which invests with an equal-weight approach across the full battery tech supply chain. This means that the ETF gets exposure to companies across a range of industries from mining, to manufacturing, to electric vehicles and technology.

Lithium batteries are essential in the electric vehicle and mobile device segments and the demand for these products is expected to grow exponentially over the coming decades. Some things I particularly like about this ETF are the equal-weight approach (which reduces overexposure to large caps) and the full supply-chain approach, which can reduce exposure to commodity prices, as price fluctuations have differing (and sometimes opposite) effects on different parts of the supply chain.

Factors I don’t love about the ETF include the relatively high management fee and the short track record – this ETF only launched in August 2018 so, compared to some of the other ETFs on this list, it is quite new.

ATEC ETF

The

BetaShares S&P/ASX Australian Technology ETF (

ASX: ATEC) provides exposure to the largest and most promising technology shares in Australia. If you’re like me, you’ve probably sat by and watched as tech share after tech share doubles its share price despite already having seemingly sky-high valuations.

Rather than trying to pick the next winner, ATEC gives broad exposure to all the likely candidates and the existing market darlings like

Afterpay Ltd (ASX: APT),

Altium Limited (ASX: ALU) and

Appen Ltd (ASX: APX).

With one simple purchase, you can get access to 50-60 companies covering sectors such as payments, cloud computing, e-commerce, and biotechnology. If you’re looking to add a high growth tactical allocation to your ETF portfolio, ATEC is certainly one worth considering in 2021.

ETHI ETF

For those environmentally-friendly investors, the

BetaShares Global Sustainability Leaders ETF (

ASX: ETHI) is one ASX ETF you should know about. ETHI is a ‘sustainable’ ETF, meaning it screens companies based on their impact on the environment and society, using

environmental, social, and governance (ESG) factors. ETHI takes a global investing approach and applies negative screening to exclude any companies involved in fossil fuels, gambling, tobacco, weapons manufacturing, deforestation, and other harmful industries.

Then, it applies positive screening to identify ‘sustainability leaders’, which are companies that derive at least 20% of their revenue from beneficial activities like recycling, renewable energy production, and water efficiency. These sustainability leaders are then given preference in the ETF.

ETHI is more expensive than your average global ETF given the extra screening criteria. However, BetaShares has proven its ability to closely track its benchmark and deliver appealing returns without compromising on ethics. ETHI has the potential to generate high long-term returns and is a virtually guilt-free growth option for a diversified portfolio.

HBRD ETF

The

BetaShares Active Australian Hybrids Fund (

ASX: HBRD) is an active ETF that invests in hybrid securities: assets that have characteristics of both shares and bonds. Unlike the other ETFs on this list, HBRD isn’t growth-focused. Instead, it’s a defensive and income-producing asset that could be worth considering as an alternative to bonds or term deposits in 2021.

The specific focus of HBRD is a type of hybrid known as a preference share. Preference shares are a type of hybrid that sits somewhere between shares and bonds on a risk-return scale. Like common shares, they are a part-ownership of a business, but like a bond, they pay a fixed or floating dividend. For example, a preferred share may pay dividends set at a rate of 3% above the Bank Bill Swap Rate (BBSW).

The catch is that preferred shares (usually) don’t come with voting rights and they don’t have the same potential for capital growth that you get from common shares. They are complex financial instruments, but the most simple way of explaining it is that they can provide returns slightly higher than an average bond ETF, but they also come with slightly more risk.

HBRD’s active management doesn’t come cheap with both a management fee and a performance fee to consider. This ETF isn’t for everyone, but for an income-starved investor, it’s an alternative worth considering in 2021.

HACK ETF

The

BetaShares Global Cybersecurity ETF (

ASX: HACK) is one of my top ASX sector ETF picks for 2021 and beyond. Cybersecurity is a rapidly-growing industry and with the adoption of cloud computing, e-commerce, and the Internet of Things (IoT), the security market looks set to continue growing steadily for many years to come.

HACK provides exposure to a portfolio of around 40 companies covering subsectors including systems software, communications equipment, and aerospace and defence. This has been a successful strategy so far, generating high returns and closely tracking its benchmark since inception.

I think HACK would make a good tactical exposure in a diversified portfolio and, because most of its holdings aren’t huge companies, it has very minimal cross over with the

iShares S&P 500 ETF (

ASX: IVV) or the

BetaShares NASDAQ 100 ETF (

ASX: NDQ) and could comfortably be held in conjunction with one of these ETFs.

DZZF ETF

Like

VDHG, the

BetaShares Ethical Diversified High Growth ETF (

ASX: DZZF) is a diversified ETF, meaning it invests in other ETFs rather than individual shares or bonds. BetaShares, in this brand new ETF launched in mid-December 2020, is combining its market-leading ethical ETFs into one convenient portfolio which has a management fee lower than the individual ETFs inside of it.

The

BetaShares Australian Sustainability Leaders ETF (

ASX: FAIR), the

BetaShares Global Sustainability Leaders ETF (

ASX: ETHI) and its currency-hedged version

HETH, as well as the

BetaShares Sustainability Leaders Diversified Bond ETF (

ASX: GBND), will all be part of this new diversified ETF.

This is the first diversified ethical ETF to come to market in Australia and it’s certainly worth considering for any environmentally-conscious investors who are just starting on their investing journey, as well as more experienced investors who are looking for a guilt-free way to expand the core of an existing portfolio.

IXJ ETF

Moving to healthcare, the

iShares Global Healthcare ETF (

ASX: IXJ) holds approximately 120 companies across the biotech, healthcare, medical equipment, and pharmaceuticals industries. Around 65% of the companies are US-based, but IXJ also provides exposure to Switzerland, Japan, the UK, Germany, Denmark, and Australia. This global ETF has strong long term growth potential as populations age, emerging economies adopt medical technology, and new methods, processes, and equipment come to market.

Over the last 10 years, IXJ has provided returns similar to that of the broader

S&P 500 Index, so it’s no surprise it’s the largest ASX-listed healthcare ETF. In my view, IXJ would make a good tactical growth allocation in a diversified ETF portfolio.

ASIA ETF

The

BetaShares Asia Technology Tigers ETF (

ASX: ASIA) was one of the top-performing ASX ETFs in 2020, returning around 62% during the year (this comes with the usual warning that this ETF has a short track record and shouldn’t really be judged on past performance).

ASIA holds a portfolio of approximately 50 technology companies from China, South Korea, Taiwan and India, including some big names like

Samsung Electronics Co Ltd and

Tencent Holdings Ltd.

The ASIA ETF provides exposure to a range of technology sub-sectors including electronic manufacturing, IT consulting, interactive home entertainment, and semiconductors. In an ETF portfolio, ASIA can provide growth potential while diversifying away from the usual US tech shares investors look to for growth.

MVW ETF

Australian investors, unfortunately, have to deal with a very top-heavy and concentrated domestic market, with more than 50% of the

SPDR S&P/ASX 200 ETF (

ASX: STW) invested in financials and materials. The

VanEck Vectors Australian Equal Weight ETF (

ASX: MVW) could be a solution with its unique approach to the ASX 200.

Instead of using a market-cap-weighted strategy and concentrating investments in the largest Australian companies, MVW uses an equal weight strategy and allocates funds evenly across the top 200 companies. This greatly reduces the allocation to financials and materials to just over 30% of the portfolio, while increasing allocations to sectors like information technology, real estate, and consumer discretionary.

MVW does charge a higher management fee than most market-cap-weighted Australian share ETFs, but after fees, MVW returned 10.44% per year over the five years to 31st December 2020 compared to 8.54% per year from STW. 2021 might be the year to rethink how you invest in Australian equities, and MVW could be the way to do it.

Summary

So, those are my top 10 ASX ETFs in Australia (click the links for the full reports):

These might not be the absolute top-performing ETFs of this year or next -- so I'm

not suggesting they will perform best over every 12-month period -- but there’s a good mix of diversified funds, ethical ETFs, high-growth tech exposure and more defensive assets; ETFs can offer something for everyone.

Whether you’re new to investing or an experienced investor looking to expand your portfolio, I hope this list has given you some ideas on where to look.

VDHG is a high growth portfolio with 90% growth assets (like Australian and international shares) and 10% defensive assets (like bonds and fixed interest assets). Diversified ETFs are possibly the easiest way to start investing as one purchase gives you access to a fully diversified portfolio, and you don’t even need to worry about rebalancing as it’s done for you within the ETF.

VDHG is a high growth portfolio with 90% growth assets (like Australian and international shares) and 10% defensive assets (like bonds and fixed interest assets). Diversified ETFs are possibly the easiest way to start investing as one purchase gives you access to a fully diversified portfolio, and you don’t even need to worry about rebalancing as it’s done for you within the ETF.

VDHG is a high growth portfolio with 90% growth assets (like Australian and international shares) and 10% defensive assets (like bonds and fixed interest assets). Diversified ETFs are possibly the easiest way to start investing as one purchase gives you access to a fully diversified portfolio, and you don’t even need to worry about rebalancing as it’s done for you within the ETF.

VDHG is a high growth portfolio with 90% growth assets (like Australian and international shares) and 10% defensive assets (like bonds and fixed interest assets). Diversified ETFs are possibly the easiest way to start investing as one purchase gives you access to a fully diversified portfolio, and you don’t even need to worry about rebalancing as it’s done for you within the ETF.