Tax on ETFs, ETF distributions and Distribution Reinvestment Plans (DRPs) can seem confusing at first. This investor guide explains what is a distribution and offers an overview of DRPs for ETF investors.

Each ETF will have a Product Disclosure Statement (PDS) that lays out how often distributions are expected to be paid and details on how to participate in any DRP. Typically, you’ll need to use your shareholder number to log into the share registry (E.g. Computershare, Link Market Services, Boardroom, etc.) and activate the DRP.

ETF Distribution Reinvestment Plans (DRPs) explained

A distribution is a return of money to you, the investor, from an ETF or fund. Unlike a dividend, you receive from a share (E.g. Telstra, BHP, etc.), a distribution from an ETF can include:

- Dividends from the shares (or bonds) inside the ETF;

- Returns of capital (e.g. short-term capital gains);

- Foreign income; and/or

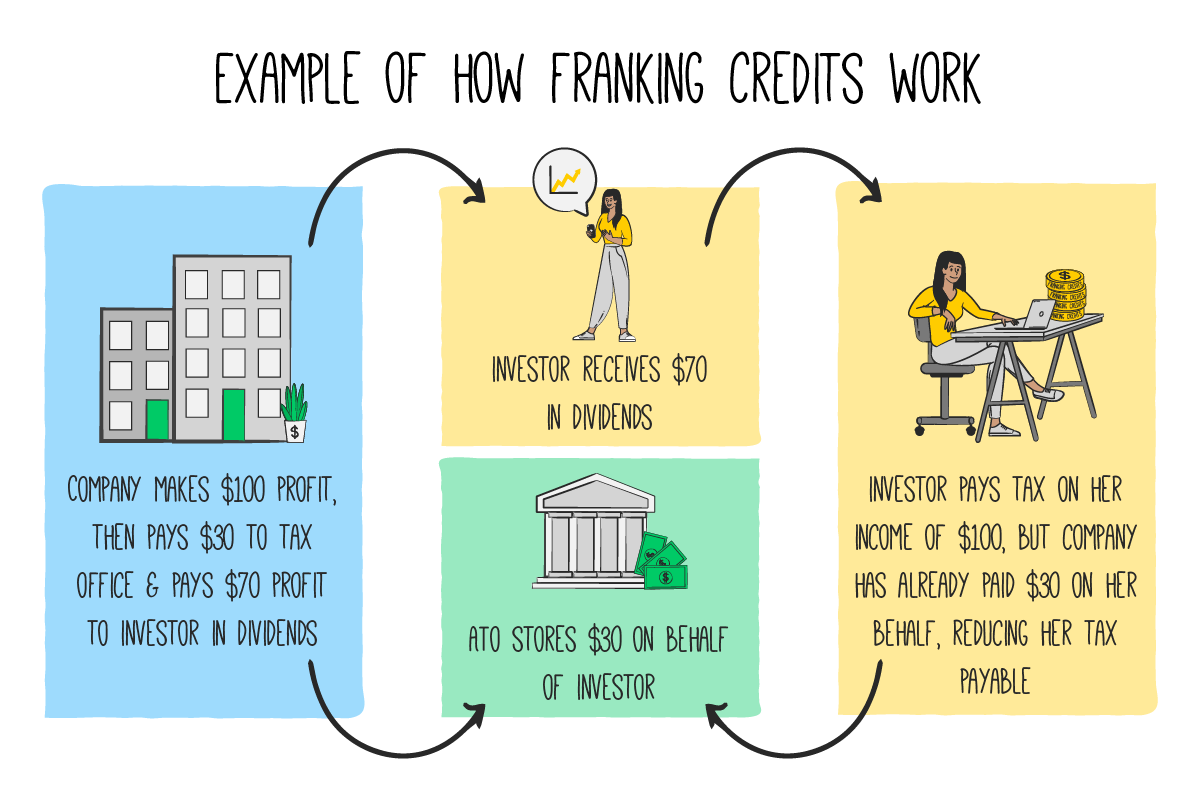

- Franking credits (stored at the ATO, which you claim)

Importantly, the distribution you receive from your fund might not match the cash you get.

At its very core, an ETF is just a trust. A trust can hold an investment on your behalf (e.g. shares) but it must ‘pass’ the tax back to you, the investor, otherwise, the taxes will be very high. This is different to a company structure which can hold the assets and pay tax at the company rate (e.g. 30%, no capital gains discount, etc.).

Don’t worry: low-cost index fund ETFs can be much more tax-efficient than other types of investments (e.g. active managed funds or thematic ETFs).

Tax on ETF distributions explained

Please note: the information below applies to ETFs/funds that have Australian tax domicile. If you invest in an ETF with US tax domicile you will have to fill in a W8-BEN form to avoid being subject to higher than necessary US withholding taxes.

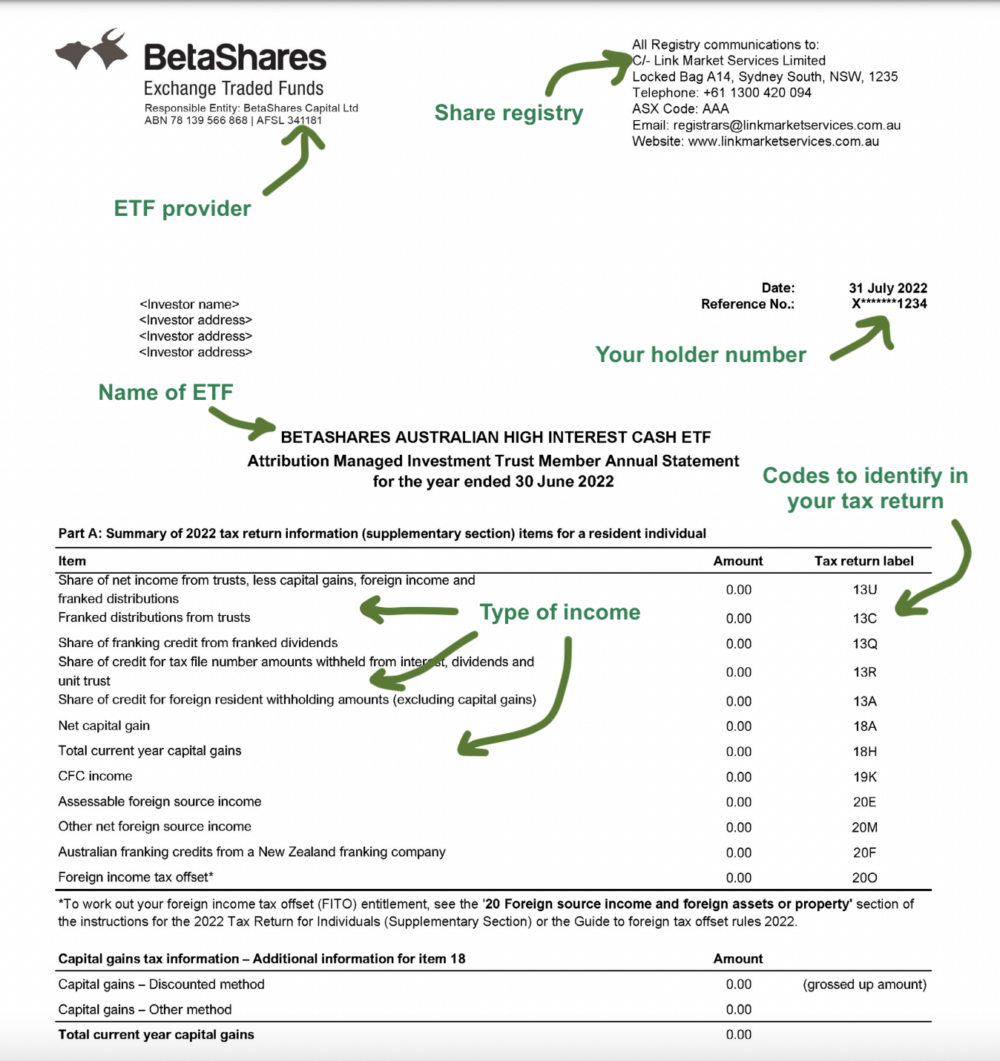

Every year, between mid-July and late August, your ETF provider will send you an annual tax statement that contains all of the information you need to report to the Australian Tax Office (ATO). You will receive a statement for every ETF and fund you own.

The annual tax statement will show all of the different types of income you need to report, often with instructions and references on where it should be reported. These reports are now being made available by email.

You will also incur capital gains tax (CGT) if you buy then sell for a profit (e.g. buy at $10 and sell at $15 = $5 capital gain). Australians receive a CGT discount for holding shares for longer than a year.

How can I make tax on ETFs easier to manage?

There are some super easy ways to make your tax easier to manage, including:

- Create an account with the share registry (e.g. Computershare, Link Market Services, etc.) and ensure it has your tax file number (TFN) recorded;

- If your broker and share registry have your TFN recorded you will likely find your tax return can use “auto-fill” to record your tax information;

- Hold onto your investments for the long run (to get the CGT discount);

- Opt to receive digital/emailed versions of your shareholder documents;

- Don’t forget to claim your franking credits when you invest in Australian shares ETFs;

- Identify ETFs with low turnover. Funds with high turnover (lots of a buying and selling) will incur more tax;

- Use a portfolio tracking tools (e.g. Sharesight) to keep track of performance, income and dividends;

You read our full guide to ATO tax on share investing in Australia.

Warning: some “dividend-focused” ETFs claim to provide ‘good income’ but are actually ‘robbing Peter to pay Paul’ and distribution some term capital gains instead of true dividends (which means the ETF’s share price will keep falling).

At Rask, we have a free course on managing taxes, aptly called the Tax Crash Course.

Do ETFs pay franking credits?

Yes, if they invest in shares that pay franking credits. Remember, an ETF is a ‘pass through’ structure, so if an ETF receives franking credits from the investments they will be paid back to ETF investors who are eligible to receive them.

ETF distribution frequency

Most ETFs in Australia will pay their distributions “semi-annually”, which means “every half year”. However, it can vary.

- A monthly distribution means the ETF or managed fund expects to return income (generated by the fund) or excess capital gains back to you, the investor, every month. Few funds outside of REITs, cash ETFs/trusts and low duration debt funds can reliably offer monthly returns.

- A quarterly distribution means the fund pays a return every quarter. This is quite common for bond funds, cash trusts, REITs and some income focused funds.

- A half-yearly distribution means the fund pays a return, every six months. There are the most common ways of returning dividends and genuine income to investors.

- A yearly distribution means the fund pays a return every year (typically around June/July). These are equally the most common and funds that offer exposure to shares will often pay distributions every year.

Are ETF distributions guaranteed?

No. This is why most funds PDS’ will say they “expect to pay” … distributions [every quarter]. However, for cash ETFs or diversified Australian shares ETFs you can reliably expect a distribution at least once a year. See our list of Australian shares ETFs.

Help! My ETF fell X% at in June/July!

Many new ETF investors get extremely worried when their ETF falls 3%, 5% or even 10% around June 30th every year. As we noted above, the value of any capital gains, dividends or foreign must be back to you as the investor at tax time, so it’s normal to see an ETF’s share price fall around June 30th (tax year). I repeat: it’s normal to see an ETF’s share price fall when a distribution is announced.

For example, imagine a US shares ETF that currently trades at $100 and inside of it has, without you knowing, $5 of taxable income and capital gains ready to be distributed. Around June 30th, the ETF will trade ‘ex-distribution’ which simply means it no longer (excludes) the distribution. So, if you hold onto the ETF after it announces the distribution you will get the $5 of distributions and the share price will fall to $95 to adjust for the payment.

ETF DRPs explained

On the ASX, some ETFs/funds will offer your distributions as cash — or as new units in the ETF/fund, as part of a distribution reinvestment plan or DRP.

How can I reinvest distributions in a DRP?

Most ETFs on the ASX will offer their investors a ‘full or partial‘ DRP — giving you the option to take none, some or all of your distributions/dividends as new units in the fund. After a full or partial DRP, the next most common type of DRP option is when a fund offers no DRP at all. This would mean all distributions must be paid back to you as cash/direct deposit, regardless of whether you wanted to reinvest the distributions.

To check if your ETF offers a DRP, refer to the ETF Provider’s website, our Best ETFs reports, or read the PDS.

How do I select a DRP option for my ETF or fund?

The ETF/Fund’s Product Disclosure Statement (PDS) should tell you which DRP options are available to you and how it works.

However, most ETFs now follow a similar process of allowing you to activate the DRP on the share registry’s website. Here’s how you can figure it out:

- Search for the fund/ETF in the Best ETFs Australia list of ETFs

- Navigate to find the ‘Registry’ section

- Using your shareholder information (available on the paperwork you receive) to log-in to the registry’s website

- Find the option to set your preferences in the DRP (e.g. ‘full DRP’ or ‘partial DRP’)

Here’s a list of the most popular share registries:

What type of DRP is best?

There is no right or wrong answer for what type of DRP is best. However, for flexibility, we’re seeing more ETFs/funds offer their investors full flexibility by opting to go with a ‘full or partial’ DRP. Most large share registries offer this functionality for fund managers and their investors.

Best dividend ETFs

Please don’t be fooled by “historical yield” when searching for ETFs — as you have learned, this can include capital gains or other types of income that may not be sustainable.

There are many different ways to target income from ETFs, including:

- Cash ETFs, such as BetaShares AAA ETF (ASX: AAA)

- Bond ETFs, such as Vanguard Australian Fixed Interest ETF (ASX: VAF)

- Vanilla Australian shares ETFs, such as that are diversified — the SPDR S&P/ASX 200 ETF (ASX: STW) is a popular choice

- Dividend yield-focused shares ETFs, like the Vanguard High Yield Australian Shares ETF (ASX: VHY). This ETF is profiled below.

When selecting your ETFs or funds it really comes back to the level of risk you’re willing to take to get income. For example, in a typical market environment, the AAA cash ETF will have far less volatility than the Vanguard VHY ETF, but VHY will offer some franking credits and potentially a higher yield than AAA.

We recently a full series on passive income investing for The Australian Investors Podcast. Be sure to tune in to watch the full masterclass on income investing.