The BetaShares Australian Composite Bond ETF (ASX: OZBD) began trading on the ASX yesterday.

It provides investors exposure to a basket of Australian government and corporate fixed-income assets.

https://education.rask.com.au/2020/01/09/what-is-an-exchange-traded-fund-etf/

If all this sounds like a bunch of corporate jargon – don’t stress.

We’ll dive into the ETF and the role it could play in your portfolio.

Fixed income? Bonds?

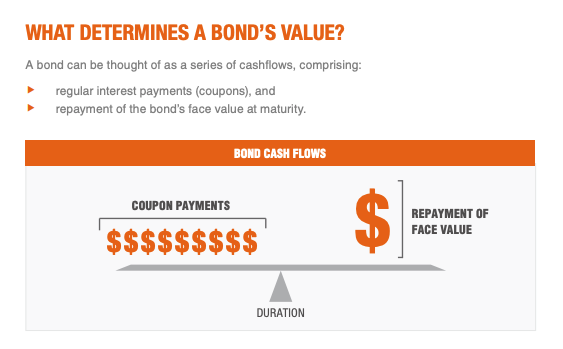

Fixed income is an overarching term to describe loans, bonds or other assets that pay a pre-determined interest payment over the life of the asset.

An example of a fixed income asset is a mortgage.

Households agree to take out a 30-year mortgage, with monthly interest and principal payments over the life of the loan.

Bonds are not too dissimilar from mortgages. The key difference is that they are issued by governments and corporations.

What’s the difference between shares and bonds?

Shares, also known as equities, represent a slice of ownership in a company. Investors are able to vote on the direction of the company and share in any profits.

Conversely, fixed-income assets such as bonds represent ownership over the debt.

Bondholders do not gain from the rising value of a business. But if the business value falls, it still receives a steady stream of income.

In the event a company fails, bondholders will be paid before equity-owners.

For that reason, bonds are typically considered safer than equities.

The case for both shares and bonds

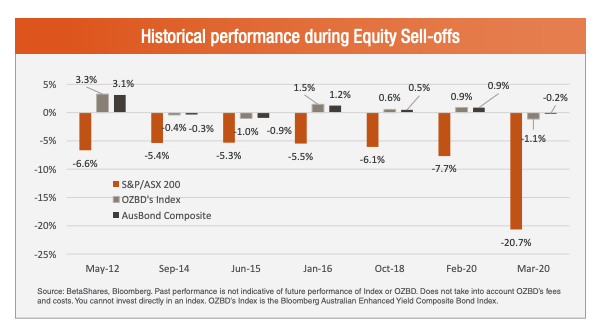

Bonds also behave differently from shares. When equity markets fall, bonds tend to perform strongly.

For that reason, bonds and equities are often found in diversified portfolios.

Bonds provide steady and regular cash flows while equities offer the upside growth of companies around the globe.

Why choose OZBD?

OZBD tracks the Bloomberg Australian Enhanced Yield Composite Bond Index for a tidy 0.19% management fee.

The ETF holds 72% off assets in Australian state and federal government bonds.

The remainder is corporate debt from companies like Woolworths and Vodaphone.

What makes OZBD unique is that the ETFs are selected on a risk-adjusted basis, meaning it’s constantly adjusting to ensure investors receive a high likelihood for income and capital appreciation.

Subsequently, OZBD has outperformed the benchmark AusBond Index in each of the past ten years.

As part of a diversified portfolio, the OZBD is a great foundation ETF providing diversified Australian fixed interest exposure.