The BetaShares Crypto Innovators ETF (ASX: CRYP) has been particularly popular with investors, amassing $129 million in funds under management (FUM) in little over a month.

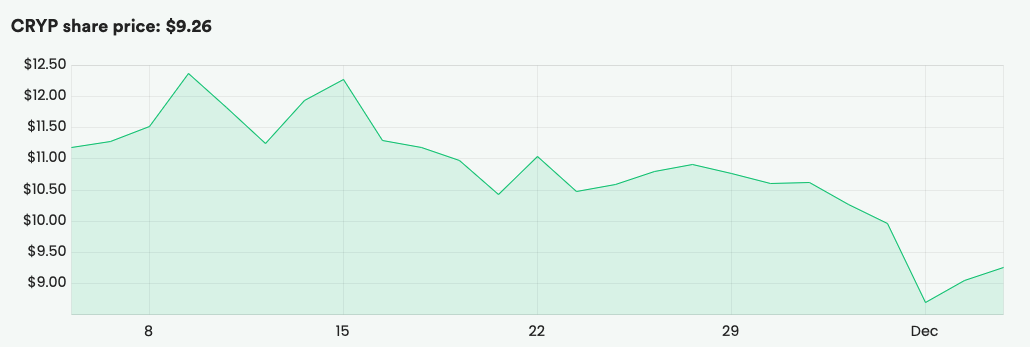

Despite its popularity, the ETF has fallen 17.25% since it was listed last month.

Subsequently, many investors will be sitting on large losses after a relatively short holding period.

What happened to the ETF? And what should you do?

If you’re new to the CRYP ETF, check our two-minute guide.

Tech sell-off weighs on CRYP

Over the months of November and early December, technology shares (such as crypto companies) have been hit particularly hard.

For example, Coinbase lost 19% of its value over the month.

Another major holding of CRYP, cryptocurrency miner Marathon Digital, lost 39% of its value.

Concerns around inflation, interest rates and the new virus variant have increased, with higher growth and high volatility companies being sold off as investors move to more stable assets.

This directly coincided with the launch of CRYP, leading to a poor first month of trading.

A note on performance

It’s worth remembering in the grand scheme of things, last month’s movement is just a minor blip in what has otherwise been a very good year for equities.

The local S&P/ASX 200 is up over 10% for the year.

Meanwhile, the tech-heavy Nasdaq (which includes Google, Apple and Netflix) is up 23% for the year.

If you want to continue to gain exposure to the crypto landscape, CRYP remains a solid option for investors to get diversified exposure.

Always read the PDS

You’ve probably heard head honcho Owen go on about Product Disclosure Statements (PDS).

It’s not the most riveting literature, but it’s worth reading in-depth before diving into any ETF (or investment for that matter).

The PDS for the CRYP ETF states:

“…an investment in the Fund should be considered very high risk. The Fund provides concentrated exposure to companies involved in servicing crypto-asset markets or which have material investments in crypto-assets. Cryptoassets are highly speculative in nature and companies with significant exposure to crypto-asset markets can be expected to have a very high level of return volatility“

The PDS also goes on to say that an investment in CRYP should be a smaller part of a larger portfolio:

“…an investment in the Fund should only be considered as a small component of an investor’s overall portfolio”

Final thoughts

Seeing the value of investments fall is not a nice feeling.

But remember that the market will go up and down every day, every month and every year.

If you approach CRYP as a high-risk and high-reward play with a small allocation, I think it still demands a spot in a portfolio.