The BetaShares Global Sustainability Leaders ETF (ASX: ETHI) provides investors with exposure to the 200 largest climate leaders in markets outside of Australia.

Notable stock holdings include Apple Inc (NASDAQ: AAPL), Home Depot Inc (NYSE: HD) and PayPal Holdings Inc (NASDAQ: PYPL).

The ETHI ETF is certified by Australia’s leading organisation of responsible investors, the Responsible Investment Association Australasia (RIAA).

The following video, which comes from our free ethical investing course, explains the meanings of key terms to know when you want to invest ethically.

Ethical screening process

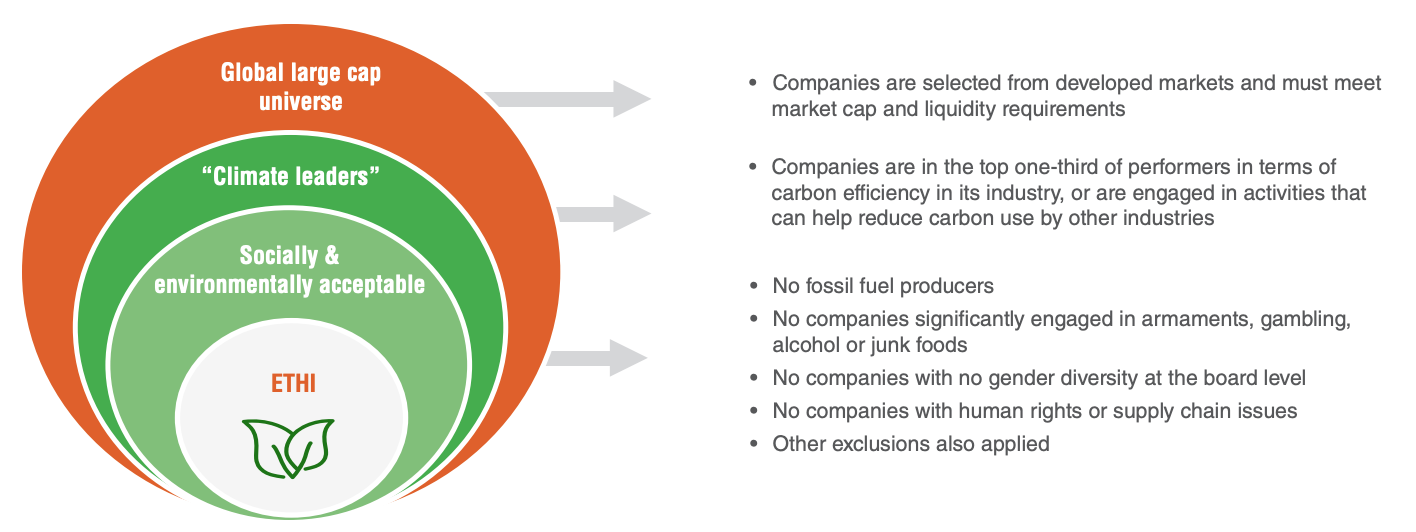

The investment process is three-fold.

The index first selects stocks/companies in developed markets with a market capitalisation greater than $2 billion and those that achieve certain liquidity requirements.

Then companies must have a carbon efficiency (carbon emissions divided by revenue) that places it in the top one-third of companies in its industry or a high performer in Scope 4 carbon emissions (also known as avoided emissions). The top one-third are known as climate leaders.

Finally, the index excludes any climate leader with operations in fossil fuels, significant operations in gambling, alcohol or junk food, companies with no gender diversity at the board level or companies with past human rights or supply chain issues.

ETHI’s index consists of the largest (by market capitalisation) 200 climate leaders. It is revaluated annually in May.

Past performance

Since its inception in July 2020, ETHI has returned 27.15%.

The underlying index has a 5-year return of 27.76% per annum. If you had invested $1,000 five years ago you have $3,403 today before fees. Note: past performance is not indicative of future performance.

Fees and risks

ETHI has a management fee of 0.49% per annum, with the possibility to charge an extra 0.10% to cover expenses. This brings the maximum fee to 0.59%.

Since ETHI is invested in climate leaders, it’s not well diversified across sectors. Therefore, I think it should form part of the satellite/tactical component of your portfolio.

The ETHI ETF is unhedged, meaning changes in the Australian and US dollar exchange rate will impact performance. For investors wanting a hedged product check out the BetaShares Global Sustainability Leaders ETF – Currency Hedged (ASX: HETH).

Why I like ETHI

I personally own units in ETHI primarily because I believe in the long-term, companies with a strategic focus on climate change will outperform the broader market.

To reach the Paris Agreement target of net zero emissions by 2050, companies and governments will need to make significant investments in the forthcoming years. ETHI is positioned well to benefit from this.

Fund manager Nick Griffin from Munro Partners outlines in this video why climate change is an area of interest for his fund and the structural tailwinds supporting the sector.

For more information on ETHI, check out our free ETF report here.