With healthcare well and truly in the spotlight in 2020, let’s take a look at the iShares Global Healthcare ETF (ASX: IXJ) and its merits in a diversified portfolio.

ETFs 101

Exchange-traded funds, or ETFs, are investment funds listed on a securities exchange that provide exposure to a range of shares or assets with a single purchase. ETFs can be ‘managed funds’ or ‘index funds’, or in other words, active or passive.

Getting to know the IXJ ETF

The iShares Global Healthcare ETF is a sector ETF that provides investors with exposure to companies within a certain industry or sector of the market.

Sector ETFs focus on one of the 11 Global Industry Classification Standard (GICS) sectors on the ASX, including financials, consumer staples, information technology and, of course, healthcare.

The IXJ ETF invests in a basket of biotechnology, healthcare, medical equipment and pharmaceuticals companies across the globe. At the time of writing, the ETF has around 120 holdings, primarily in the United States which accounts for 67% of the fund. Smaller weightings are given to Switzerland (10%), Japan (6%), the UK (4%) and Denmark (3%), among others.

Its top holdings include the likes of Johnson & Johnson, Novartis, Pfizer and AstraZeneca.

Aside from providing global diversification for ASX investors, the iShares Global Healthcare ETF offers tactical exposure to a sector with tailwinds at its back – the strongest being ageing populations across the world that will start to require greater amounts of care.

How has the IXJ ETF performed?

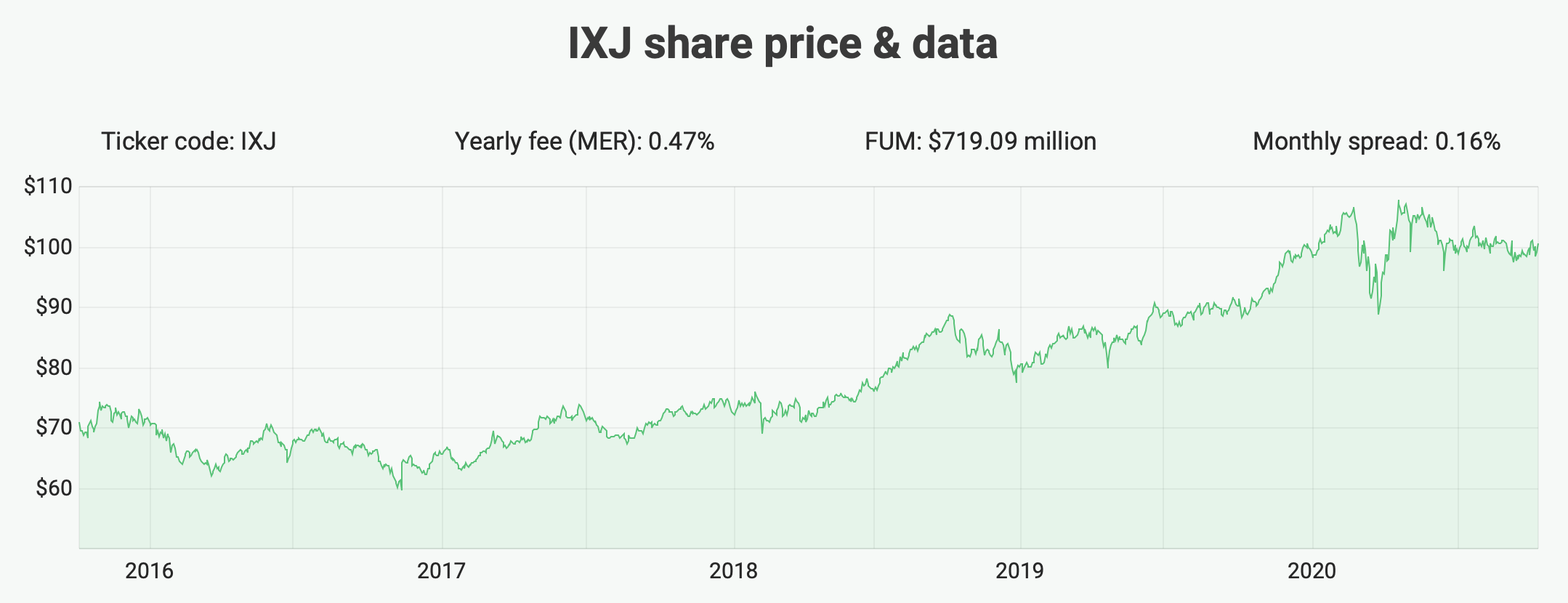

Of course, past performance is not indicative of future performance, but here’s how the IXJ ETF has fared in recent years.

According to iShares, over the past year, the IXJ ETF has achieved a total return of 12.01%. Going back further, the ETF has delivered growth of 16.48% per year over the last 10 years.

Since inception all the way back in 2001, the fund has returned an average of 5.65% per annum.

These returns include semi-annual distributions, and the 0.47% yearly management fee has also been taken into account. Based on historical distributions, the ETF currently offers a yield of around 1.47%.

Is IXJ a good ETF?

The IXJ ETF may be suitable for Australian investors searching for global exposure to the healthcare sector.

Since this is a sector ETF, it may be more suitable as a satellite or tactical holding rather than being at the core of a portfolio. The satellite/tactical part of a portfolio is the smaller part that investors can reserve for their ‘active’ investing and riskier positions.

You can learn more about the core and satellite approach by reading the Rask investment philosophy or by watching episode 46 of The Australian Finance Podcast:

Other options in the global healthcare space include the BetaShares Global Healthcare ETF (ASX: DRUG) and the new VanEck Global Healthcare Leaders ETF (ASX: HLTH).

To read more about IXJ, check out our free report here.

[ls_content_block id=”695″ para=”paragraphs”]