Is Vanguard Australian Shares High Yield ETF (ASX: VHY) a good buy for dividend income? It could be worth considering.

About VHY ETF

As the full name suggests, VHY ETF looks to invest in high yield Australian shares. When it comes to dividend income, Australian shares offer an advantage because they come with franking credits.

This ETF looks to maximise income with businesses that are expected to pay higher-than-average dividends. Real estate investment trusts (REITs) are excluded, whilst industry exposure is limited to 40% and exposure to one company is limited to 10%.

Some of its biggest holdings include: BHP Group Ltd (ASX: BHP), Commonwealth Bank of Australia (ASX: CBA), Wesfarmers Ltd (ASX: WES), Transurban Group (ASX: TCL) and Telstra Corporation Ltd (ASX: TLS).

Other similar ETFs

There are other ASX ETFs like Vanguard Australian Shares Index ETF (ASX: VAS) and BetaShares Australian Dividend Harvester (ASX: HVST).

How has the ETF performed?

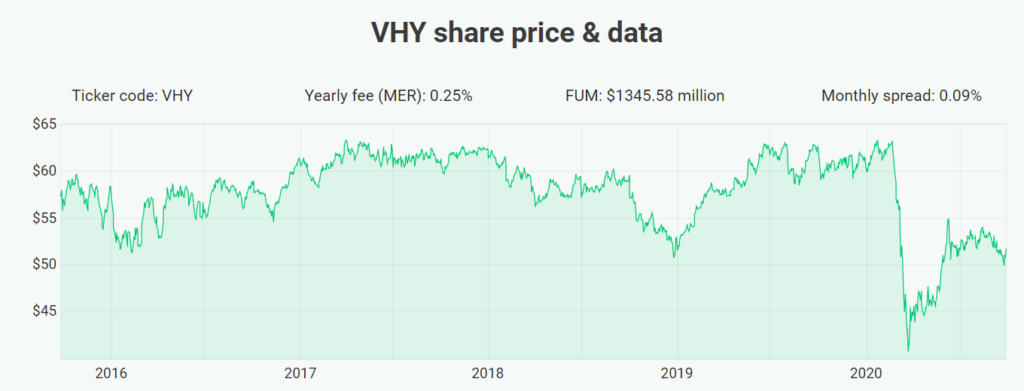

Over the past five years it has delivered average total returns of 4.08% per year. However, that boils down to 6.4% in income distributions and a decline in capital value of 2.35% per annum.

Is VHY ETF a good buy for dividend income?

To specifically answer about dividend income – yes, it does seem to offer a better-than-market yield because of its underlying holdings.

However, generally the underlying businesses haven’t seen share price growth because their profit growth has been poor (at best). No growing profit probably means no sustainable growth of the VHY distribution. Indeed, many ASX shares like Telstra and Westpac have cut their dividends in recent years.

I’d rather start with a smaller dividend yield that grows, than a large one that may fall. Capital declines over the longer term is not attractive.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]