There are three quick reasons why I like the iShares Global 100 ETF (ASX: IOO) ETF. Good diversification is one of those reasons.

About IOO

This ETF is invested in 100 of the biggest businesses in the world through a single fund. It can be invested in both developed and emerging markets.

The IOO ETF is not a country-specific fund, it can be invested in whichever country it needs to be allocated to. This is attractive diversification in my opinion.

Looking at the ETF’s top holdings, it owns names like: Apple, Microsoft, Amazon, Alphabet, Johns & Johnson, Nestle (a European-listed business), Proctor & Gamble, JPMorgan Case and Samsung (an Asian-listed business).

There are plenty of other non-US investments such as Novartis, Toyota, AstraZeneca, LVMH, Sanofi, Siemens, Sony, GlaxoSmithKline and Total.

It has an annual management fee of 0.40% per year.

Other similar ETFs

There are other ETFs which give a similar type of global diversification, though it comes with more holdings like Vanguard MSCI Index International Shares ETF (ASX: VGS).

How has the ETF performed?

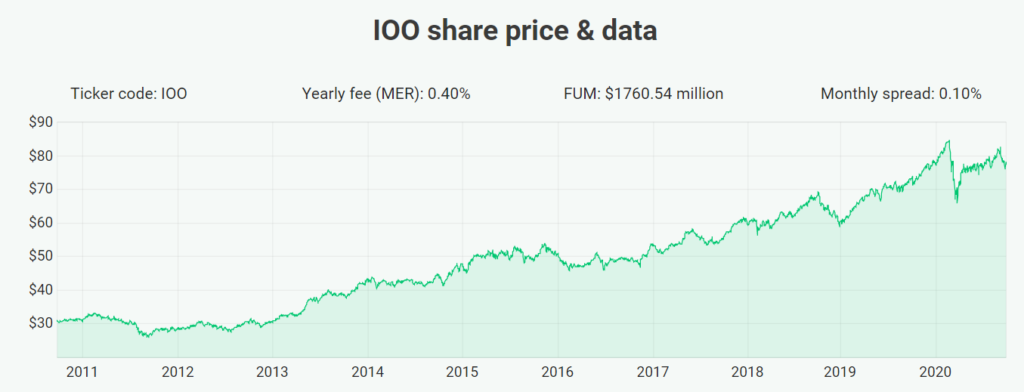

Over the past decade the IOOF ETF has delivered average returns per year of 13.1%.

3 quick reasons I like IOO:

Not Australian – I believe it’s important for most Aussies to diversify their portfolios away from just ASX shares. Australia has some good companies, but the ASX only makes up 2% of the global market capitalisation.

Diversification – Around 71% of the IOO ETF is invested in US shares, but the rest is spread across other countries like Switzerland, the UK, France, Germany and Japan.

Whilst there’s a big allocation to IT (with good growth) there is good exposure to other growth areas like ‘consumer discretionary’, ‘health care’ and ‘consumer staples’.

Growing strength of investments – The biggest businesses seem to be getting stronger every year. The economic moats of companies like Microsoft, Alphabet and Apple are getting more entrenched. This is what helps deliver strong shareholder returns.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]