Is the Vanguard MSCI Index International Shares ETF (ASX: VGS) the best option for passive investing on the ASX? There are plenty of ETFs to consider.

About VGS

The VGS ETF is about giving investors exposure to leading businesses listed across many major developed countries.

It actually owns positions in over 1,500 businesses. So it offers a lot of diversification.

In terms of sector allocation, the biggest exposure is to IT with an allocation of around 23%. There are other sectors with allocations of more than 10%: healthcare, consumer discretionary, financials and industrials.

Looking at the biggest individual positions the VGS ETF owns businesses like Apple, Microsoft, Amazon, Alphabet, Facebook, Johnson & Johnson, Tesla, Nestle, Visa and Procter & Gamble.

There is a heavy focus on ‘US’ businesses in the top holdings because that’s generally where the largest global companies are listed. However, there are other ones like SAP, ASML, Novartis and LVMH.

Other similar ETFs

There are plenty of ETFs based on the global share market like iShares Global 100 ETF (ASX: IOO) and BetaShares Global Sustainability Leaders ETF (ASX: ETHI).

How has the ETF performed?

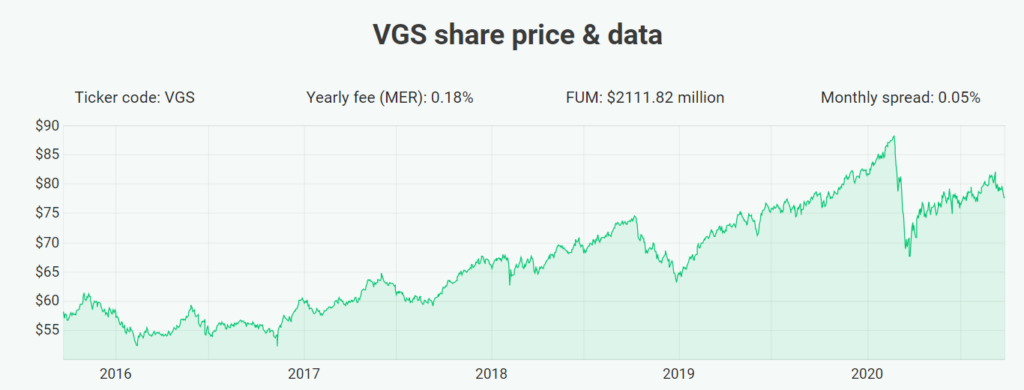

The past five years have seen a couple of volatile periods including the end of 2018 and the COVID-19 crash. Even so, the average return per year over the past five years has been 9.65% (which includes the decline due to COVID-19).

Is VGS the best ETF for passive investing?

VGS ETF offers a lot of very useful diversification. It provides exposure to businesses right across the world – that’s probably better than being invested in just one share market like iShares S&P 500 ETF (ASX: IVV), however VGS ETF’s annual management fee of 0.18% is more than IVV ETF.

Over time the ETF’s holdings will change and that will allow investors to stay invested in VGS ETF without worrying about those holdings becoming irrelevant to the business world.

I think it’s one of the best options for passive investing with its strong diversification. It won’t ever shoot the lights out, but it should be able to keep going higher with a decent dividend yield.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]