The Vanguard All-World ex-US Shares Index ETF (ASX: VEU) has just announced a dividend. Is it a good investment?

About VEU

This ETF looks to give investors exposure to many of the world’s listed in countries outside of the US.

It gives investors strong diversification because it has over 3,300 positions, which is a very large number. It comes with an annual management fee of just 0.08%, which is one of the cheapest that Aussies can get.

Its largest holdings include names like Alibaba, Tencent, Taiwan Semiconductor Manufacturing, Nestle, Samsung, SAP, Unilever and Toyota.

Other similar ETFs

The VEU ETF is invested in places like Canada, Brazil and South Africa. But you can largely get similar investments with ideas like Vanguard Ftse Europe Shares ETF (ASX: VEQ), Vanguard FTSE Asia Ex-Japan Shares Index ETF (ASX: VAE) or Vanguard Msci Index International Shares ETF (ASX: VGS).

How has the ETF performed?

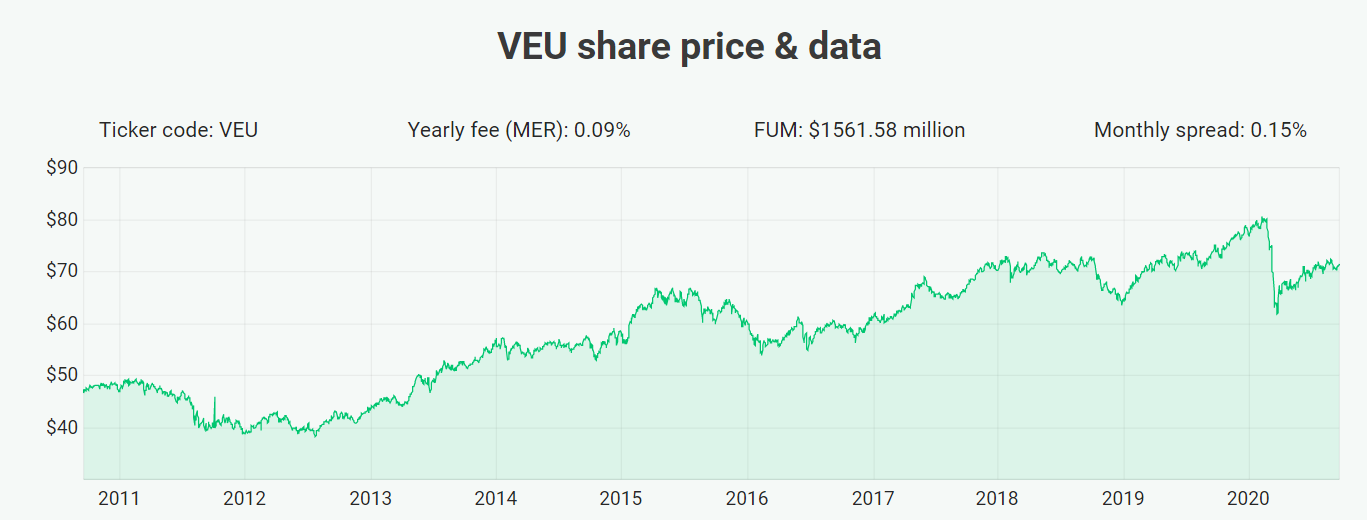

As you can see on the graph, there has been volatility over the years with Europe suffering during the early 2010s and COVID-19 in recent times.

According to Vanguard, over the past 10 years the ETF has delivered average net returns of 7.5% per year.

VEU ETF distribution

The VEU ETF recently announced a final distribution of US$0.3416 per unit.

According to Vanguard, at 31 July 2020 the ETF offered a dividend yield of 3.1%, which isn’t terrible at all. However, COVID-19 may impact near-term distributions because of recent hits to profit.

I think VEU is a very good way to provide diversification with its global holdings. However, many holdings have brought down the net performance over the years. I prefer ETFs with more tech exposure and growth like BetaShares NASDAQ 100 ETF (ASX: NDQ).

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]