I think there are at least two reasons to love Vanguard Diversified High Growth Index ETF (ASX: VDHG).

About VDHG

The idea behind the VDHG ETF is that it provides low-cost access to a range of other funds across multiple asset classes. As the name suggests, it’s largely invested in growth assets with a 90% allocation and a 10% allocation to income asset class.

So, what ETFs does it actually invest in? I’ll tell you:

- Vanguard Australian Shares Index Fund

- Vanguard International Shares Index Fund

- Vanguard International Shares Index Fund (Hedged)

- Vanguard Global Aggregate Bond Index Fund

- Vanguard International Small Companies Index Fund

- Vanguard Emerging Markets Shares Index Fund

- Vanguard Australian Fixed Interest Index Fund

Quite the list.

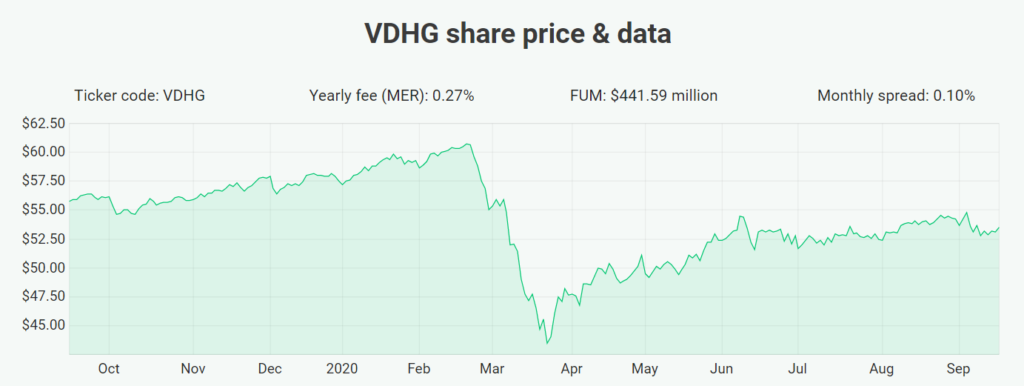

It has an annual management fee of 0.27%.

Other similar ETFs

Vanguard offers other diversified ETFs with less focus on growth such as Vanguard Diversified Balanced Index Fund (ASX: VDBA). Other ETF providers have options like the BetaShares Diversified High Growth ETF (ASX: DHHF).

How has the ETF performed?

COVID-19 has had a tough impact on VDHG ETF. Over the past year to 31 August 2020, it has delivered a total return of around 2.5% according to Vanguard.

2 reasons to love VDHG

There are lots of good reasons to like investing in ETFs generally. But the VDHG offers strong diversification with a single investment. You don’t have to worry about how much of each ETF to buy for your portfolio. That makes it possible to have all of your investments in just this one idea.

Another reason to like it is that it could be a very long term investment. You could hold it for decades, and its underlying holdings would regularly change so it could keep producing decent returns over the years.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]