I think there are a few compelling reasons to buy Betashares FTSE 100 ETF (ASX: F100) right now.

About F100

This ETF gives investors access to 100 blue chip companies on the London Stock Exchange. The UK is a fairly close to Australia in many different ways, so I think investors can take confidence in that.

Many of F100’s biggest holdings are actually global businesses, so don’t think of this ETF as just a UK business ETF. Its biggest holdings are: AstraZeneca, GlaxoSmithKline, HSBC, British American Tobacco, Diageo, Rio Tinto, Unilever, BP, Reckitt Benckiser and Royal Dutch Shell.

Other similar ETFs

There aren’t any UK-specific ones. But there are European ETFs that own some of the UK shares I mentioned above. Examples are: iShares Europe ETF (ASX: IEU) and Vanguard FTSE Europe Shares ETF (ASX: VEQ).

How has the ETF performed?

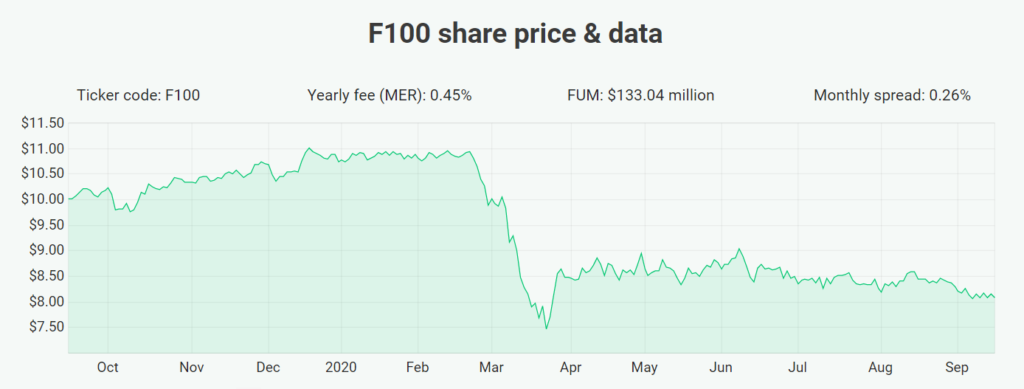

It has been tough for F100 with COVID-19 and worries about Brexit. Over the past year the ETF’s total return is a decline of 14.4%.

3 quick reasons to buy F100 right now

I think there are three good reasons to consider F100.

The first is that it looks cheaper than other international markets with a price/earnings ratio (according to BetaShares) of under 16.

The second reason is that the Australian dollar is strengthening against the UK pound with worries about Brexit. It can be a good time to invest when there’s fear.

The third reason is that I believe F100 will provide solid dividends once COVID-19 impacts are over and UK companies don’t feel strongly about holding onto capital/reducing dividend payments.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]