Could Vanguard Australian Property Securities Index ETF (ASX: VAP) be a cheap opportunity staring investors in the face?

About VAP

This ETF looks to give investors a cheap way to invest across various real estate investment trusts (REIT) including retail, office, industrial and ‘diversified’.

At 31 July 2020 it had 29 holdings. Its biggest 10 holdings were: Goodman Group (ASX: GMG), Scentre Group (ASX: SCG), DEXUS Property Group (ASX: DXS), Mirvac Group (ASX: MGR), Stockland Corporation Ltd (ASX: SGP), GPT Group (ASX: GPT), Vicinity Centres (ASX: VCX), Charter Hall Group (ASX: CHC), Shopping Cntrs Austrls Prprty Gp Re Ltd (ASX: SCP) and Charter Hall Long WALE REIT (ASX: CLW).

It has an annual management fee of 0.23%.

Other similar ETFs

Another Australian property ETF is VanEck Vectors Australian Property ETF (ASX: MVA). It has similar holdings, though with different holding percentages, with a management cost of 0.35%.

How has the ETF performed?

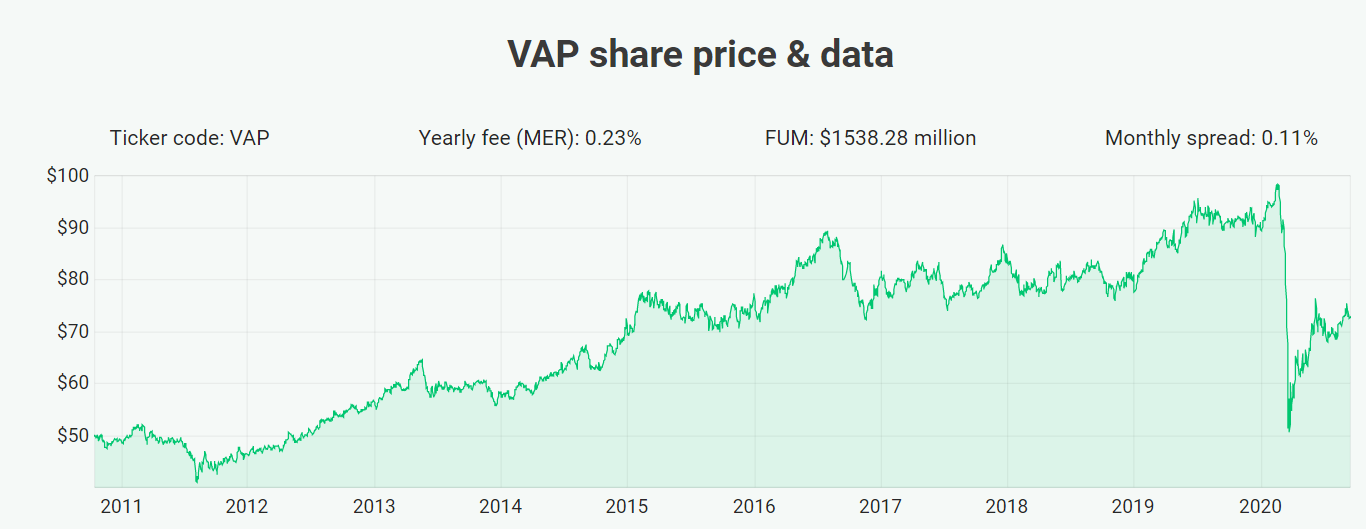

According to Vanguard, It has delivered average returns per annum of 9.74% since the ETF’s inception in October 2010.

Why it could be a cheap opportunity

The VAP share price is still down by around 25% from the original COVID-19 crash. Property share prices, particularly shopping centre ones, remain subdued due to the impacts of COVID-19.

Some property businesses have recognised a reduction in property valuations. For example, Scentre recently recognised a $4 billion valuation drop across its portfolio.

However, if you/Vanguard takes the REIT property valuations as correct, then at 31 July 2020 it had a price to book ratio of 0.9x. That means, investors could buy $100 worth of property REITs through VAP for $90. That’s an attractive 10% discount after recent revaluations.

If you think a 25% reduction of VAP is a fair price, or good price, then it could be a cheap opportunity. However, the rise of e-commerce could mean that shopping centres don’t quite recover.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]