I think BetaShares NASDAQ 100 ETF (ASX: NDQ) could be a good buy right now because of the increasing volatility.

About NDQ

NDQ gives investors access to 100 of the biggest businesses listed on NASDAQ.

Many of the businesses held by NDQ are world leaders of technology. Businesses like Apple, Amazon, Microsoft, Facebook, Alphabet, Tesla, Nvidia, Adobe and PayPal are the biggest holdings. This group sounds much better to hold than the ASX blue chips that are dominated by the mining and banking sectors.

The ETF has an annual management fee of 0.48% per year.

Other similar ETFs

There are several ETFs out there that feature many of the biggest businesses in the US like iShares S&P 500 ETF (ASX: IVV) and Vanguard U.S. Total Market Shares Index ETF (ASX: VTS). However, the ‘FAANG’ shares make up a smaller proportion of these two ETFs because they have many more holdings – as the name suggests, the IVV ETF has 500 holdings, compared to just 100 for NDQ.

How has the ETF performed?

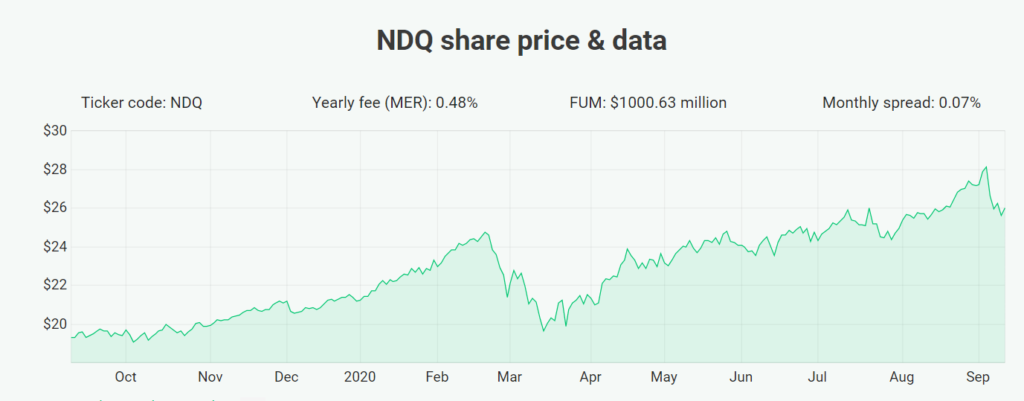

You can see on the chart that over the past year the ETF has been volatile, but it has climbed substantially over 2020. At 31 August 2020 it had made a net return of 44% over the previous year, 30% per annum over the previous three years and 22.4% per annum since inception in May 2015.

Why it’s a good time to buy NDQ

I think it’s a good time to buy NDQ because the NASDAQ 100 has fallen by about 10% over the past week or so. However, the biggest shares continue to report impressive numbers considering everything that’s going on with COVID-19. A drop in price but strong business performance makes NDQ look better value to me. As a group, I believe these businesses can keep performing over the long-term. But the next six months could be volatile (partly due to the United States election), and a buying opportunity.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]