When I was younger, living on the family farm and away from the bright city lights, we could look up and see the stars.

As a bit of a space nerd, it was terrific to see thousands of stars lighting up the sky. But then one day my uncle came to visit…

We walked out onto the porch.

I looked up to the sky and said, “look at all of those stars.”

“Don’t look up!” he interjected.

“They’re all satellites looking back at us.”

You can imagine my… surprise.

Fortunately, I was old enough to know what he said was hysterical.

But what concerned and intrigued me the most about his belief was, how did he get this way. How and why did his internal compass get it so wrong and what was it holding him back from?

Now I know that when it comes to the unknown, whether we’re talking space and stars or simply the sharemarket, humans place so much emphasis on how we feel to inform our worldview. In doing so, we lose track of the brilliant opportunities in front of us.

Here are three myths about sharemarket investing…

1. Investing is a male-only sport.

In 2019, to say the audience at our investing events was a majority male would be the understatement of the year. With our event in Melbourne later this month, we plan to change that. We hope (and expect) at least a 50-50 split.

In the meantime, consider this: investing is not only open to both sexes, women do it better!

Go online. Chances are you will find hundreds of studies confirming females outperforming males in investing. Sorry, fellas — we have some work to do.

For example, Barber (2001) conducted a study of 35,000 US households over six years. They found that men traded 45% more often than women. Overtrading ultimately helped females outperform males by 0.94% per year.

Other studies show that females, on average, tend to save more too. Ouch!

2. Complexity = profits.

For years, I thought I was the Indiana Jones of shares, in search of the Holy Grail.

I was compelled to speak to Australia’s best investors, finish my Master’s degrees in record time and read every Warren Buffett book quicker than anyone just to discover the secrets to investing.

It didn’t work. The only philosophies that I found to be consistently successful were boring, long-term buy-to-own strategies.

It made me realise that we don’t need three-phase electricity connected to our mum’s basement to power six computer monitors and awaken our ‘inner trader’.

Marshall et. al (2010) showed that the 5,000 popular technical trading techniques did not work in 49 countries.

Sure, there are more exotic combinations, tricks, strategies and styles that work well at different times, for a varying number of days, months or years.

But here’s what I’ve also found: investing complexity has a limit, and it’s lower than I first thought.

Hamish Douglass, Australia’s most prominent investor, told me his selling process could be understood using the analogy of a sports team.

If something is substituted/traded into the Magellan portfolio it must be better than the player/stock that was removed.

Simple works.

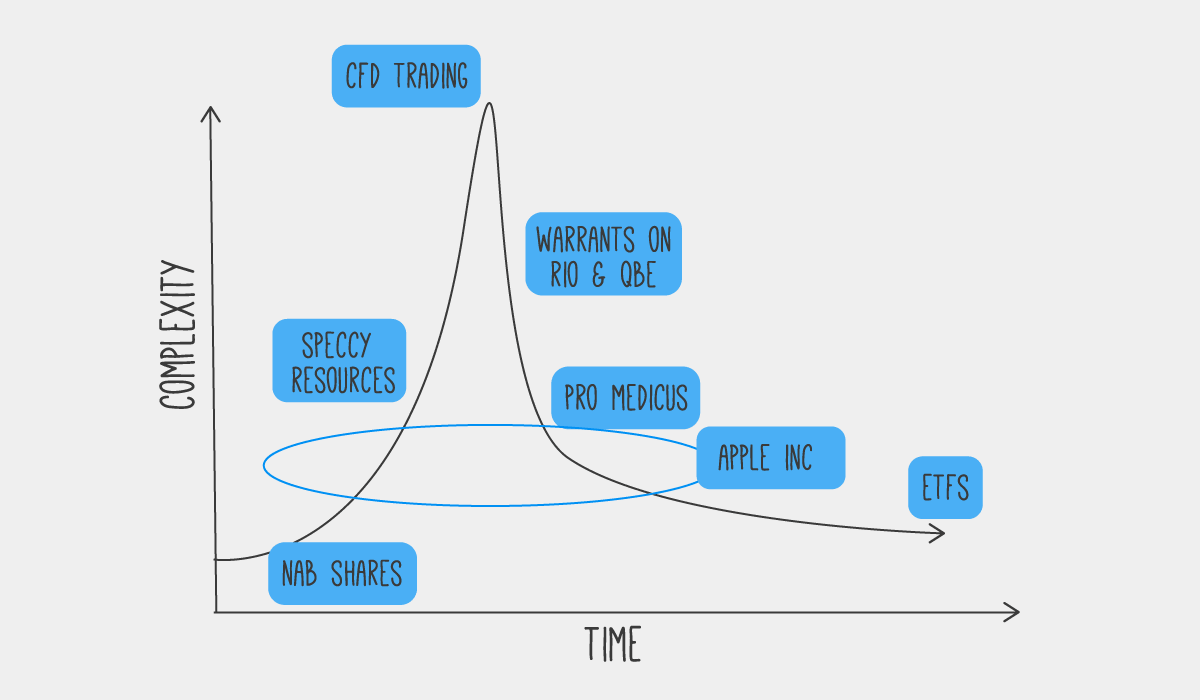

Tim Hanson, an investor from the USA, conceptualised his own investment journey as a ‘Humility Curve’. I’ve included mine below.

The chart shows how the complexity of my investing went higher as I learned more and ‘informed myself’ of new techniques. It started with buying NAB shares.

Why NAB?

Well, like many investors, I had just opened my brokerage account and I needed something to buy. Anything. I looked around the room for names of companies I might be able to buy shares of.

I thought Apple, Google and my favourite consumer brands were available on the Aussie stockmarket, but they weren’t.

NAB was the first company I could find in my brokerage account, so I bought it.

That was the beginning, the middle and the end of my investment process.

Here’s the rub: it definitely wasn’t the worst investment I ever made!

3. Investing is like gambling.

Ask a mouth-breather about shares and I’d bet he’ll say something to the effect of, “Investing is just like gambling.”

To get to that assumption it’s likely they have had one bad experience, felt the pain of loss and left it at that.

The only thing that grinds my gears more than the crooks who create brilliant advertisements for betting agencies are the mugs who compare investing (a genuinely positive financial decision for our futures) to gambling.

Even supposedly smart investors make this connection because… it has numbers… check… emotion (hope, greed)… check, and money… check!

Yeah, nah.

Again, I’ll limit my opinion to say that some investors do make money ‘trading’ stocks. Just like some punters do make money — especially poker players. And of course there are some similarities between investing and gambling (see above).

However the association between gambling and investing is tenuous at best, extremely hazardous at worst.

Firstly, you won’t see ads of highly speculative investments forced in front of your kids when they’re watching their favourite sports heroes on the TV. That’s one difference.

Secondly — this one is most important — when you invest in something, you own something.

When you invest in, for example, a share of McDonald’s Corporation, you might only see a share price bouncing up and down on your computer screen (like the odds at the TAB) but legally you own part of that business. It might only be 1/759,440,000th of the McDonald’s, but it’s something.

Investing is more akin to owning a pedigree racehorse than betting on its performance on a particular track day.

In my experience, most people who liken shares to gambling have failed to discern the differences between business risk and the random gyrations driven by Mr Market. They fail to remember that shares are part ownership of businesses.

The bottom line is, keep your investing as simple as it should be but no simpler. Investing is open to both genders and, when done right, it’s not gambling.

If, like me, you’re keen to understand how investing really works and you can imagine yourself being financially independent and in control of your finances, you should click here to take a course on Rask Education today.