The Afterpay Touch Group Ltd (ASX: APT) share price jumped 9% yesterday after releasing its hotly anticipated 2019 financial year report. Is it time to get out?

Key Performance Figures

On face value, Afterpay’s results appear extremely impressive:

- Total retailer sales: $5.2 billion, up 140%

- Number of users: 4.6 million customers, up 130%

- Number of retailers/merchants: 32,300, up 101%

- Revenue: $251 million, up 115%

As can be seen, Afterpay is growing rapidly, with just about every key operational metric (and revenue) rising at triple-digits year-over-year.

The Afterpay Business Model

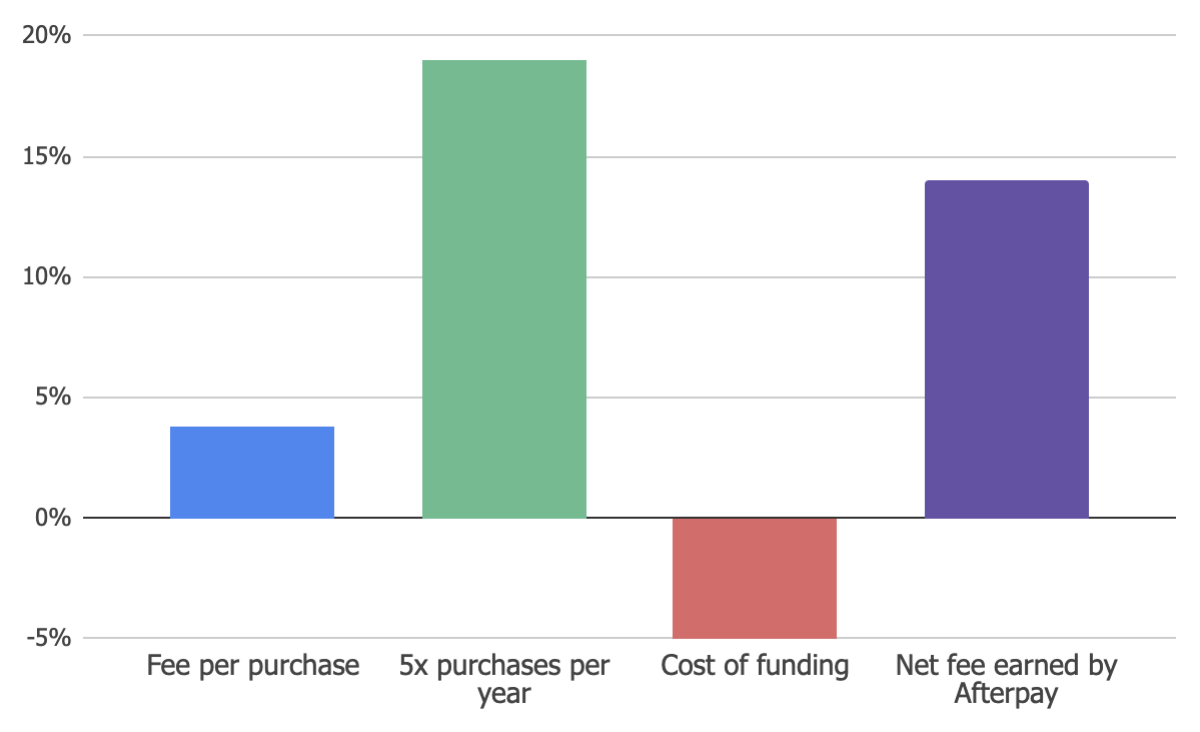

Using the chart above, we’ve provided a very basic overview of how Afterpay works.

As you can see, we could assume Afterpay makes around 3.8% from every purchase/transaction by offering short term “credit” or capital to the retailer (covering the consumer’s purchase). The customer is extended this credit for an average of, say, seven weeks.

The beautiful thing is this capital can be recycled back into the business to fund other customer purchases.

With an average repayment cycle of seven weeks, conservatively we can say Afterpay could recycle the capital/credit at least five times per year. That means Afterpay can ‘make’ 3.85% x 5 or around 19% per year (p.a.).

Again, if we assume that the capital Afterpay ‘lends’ to retailers costs 5% per year (funded by its bank loans, internal cash reserves and/or by issuing new shares), the margin for Afterpay over the course of a year might be 14% (19% – 5%).

As I say, that’s a very basic overview and it’s worth noting the 14% doesn’t take into account the net transaction loss (~0.5% of sales) from consumers who don’t pay the money back. It also doesn’t cover company expenses like marketing, labour, tax and many more real things which Afterpay’s management has to balance as it grows.

Brilliant Economics?

The ‘economics’ inside Afterpay are truly terrific.

Conversely, we think the risk to Afterpay’s business model lies in the transaction losses it will incur throughout the credit cycle. Then, there’s technological disruption and the biggest question revolves around margin compression once Afterpay, Splitit (ASX: SPT), Klarna and Affirm become mature businesses. Will retailers still be willing to pay 3.8% to Afterpay if Klarna offers the buy now, pay later (BNPL) service for less?

The pleasing counterpoint to these risks is the growth Afterpay could experience outside of its core merchants/lending business.

At Rask Invest, we think the ‘optionality’ in referral fees for merchants, advertising, data analytics on customers and cross-promotions will become more important over time.

Buy, Hold Or Sell?

Ultimately, for me, there’s a lot of risk to buying Afterpay shares at today’s prices. However, there’s arguably more opportunity in the form of new features, users, merchants and overseas growth that justifies a higher-than-average valuation.

As a result, we’ll be creating a new valuation model to determine a fair valuation range for Afterpay shares — as always, our Rask Invest members will be the first to know what we think.

[ls_content_block id=”695″ para=”paragraphs”]

Disclosure: At the time of writing, Owen has no financial interest in any of the companies mentioned.