Our team at Rask Invest has a list of watchlist stocks, in addition to our portfolio holdings, which we’re keeping tabs on. But, fortunately for us, there is only one of our ASX holdings yet to report this August — and the result is unlikely to make or break our long-term investment thesis.

As part of Rask Invest, we now provide our members with a list of ASX stocks that we’re watching very closely, through which we also go into detail about our reasons for watching them.

So, without further ado, here are three of these standout ASX stocks we don’t own but we’re watching closely this reporting season…

Altium Limited (ASX: ALU)

One of the reports the Rask Invest team and I have dug into is that of Altium (ASX: ALU), the software company that specialises in the design of circuit boards (PCBs) for manufacturing.

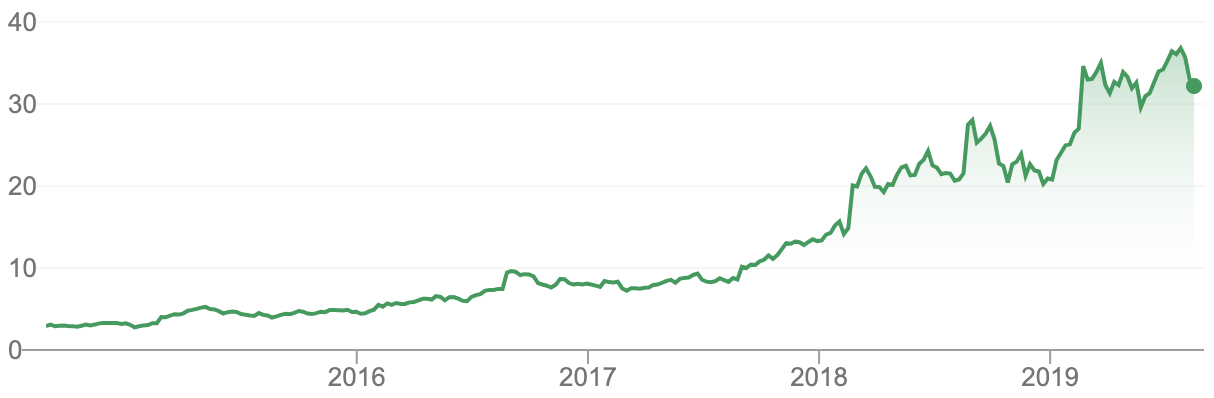

In less than five years, Altium shares have risen from under $3 to over $35. Naturally, we’re tracking it closely.

This week, Altium reported an impressive round of results, with increasing margins, a growing subscriber count and confirmation of its medium-term revenue guidance. However, it wasn’t all roses…

As Rask Invest’s new analyst, Cathryn Goh, pointed out, the company appears to have dialled back its own expectations for ‘market dominance’. For those unfamiliar, Altium’s management has set themselves bold expectations for growing market share in the PCB design industry.

And, in a world where the lines between manufacturing and design are becoming increasingly intertwined (and extremely profitable), we think investors and analysts are baking in equally bold growth targets in their Altium valuation models.

Altium could achieve its 2023 forecast of ~35% share of the PCB design market — and I’d buy shares for the Rask Invest model portfolio today if I knew for certain they would achieve that.

However, we think it’s crucial for investors to be sceptical and only buy shares when we’re offered a sufficient margin of safety between our estimate of value and the market price. Shares of great companies trading with compelling upside potential is exactly what we look for when we recommend shares to Rask Invest members.

In short, we’re still in the process of determining whether Altium will or will not achieve its aspirational targets.

But, as we said to our members recently, Altium ticks our strict quality boxes for growth, quality management, dividends and profitability (believe me when I say it’s harder than it sounds to find such a high-quality company on the ASX).

If we’re afforded a more compelling price, or if Altium keeps kicking goals, it’s possible we’ll add its shares to the portfolio.

Flight Centre Travel Group Ltd (ASX: FLT)

Another high-quality ASX stock we’re monitoring very closely this reporting season is Flight Centre (ASX: FLT).

Though the founder-run company downgraded its profit forecasts recently, it forever seems to prove the market wrong, with the leading travel agency increasing dividends and profits for many years on end.

We’re watching to see how Flight Centre’s international expansion is faring and whether the company’s fundamentals are being negatively impacted by the sluggish Aussie economy.

If it’s not as bad as investors think it is, we may be able to pick up some high yielding Flight Centre shares for less than they’re truly worth.

Afterpay Touch Group Ltd (ASX: APT)

Finally, the financial report from market darling Afterpay (ASX: APT) is probably the most anticipated update on the ASX in years. The Buy Now, Pay Later (BNPL) leader seems to be rapidly growing overseas in the US market in particular.

We’ve been monitoring the latest indicators we can find. While the company’s heavy investment in the giant US market seems to be yielding high results in terms of new user numbers, it’s the marginal return on capital (ROIC) that’s important to us.

In other words, is Afterpay’s decision to invest in the competitive USA and UK markets paying off? We’ll also be monitoring the total amount of transaction losses Afterpay is reporting on its short-term lending.

Bottom line, if Afterpay can crack the US market as it has done here at home, the company’s spectacular share price run-up could be well and truly justified.

While we don’t own Afterpay shares for the Rask Invest model portfolio, it’s on our watchlist (for obvious reasons). In the meantime, we’re happy to let other investors take the plunge until we’re thoroughly convinced the risk-reward profile is weighted substantially in our favour over the long run.

What Now?

If we can — and we believe we can — own a portfolio of 15-30 of the best long-term growth stocks we can find, we’re confident we can achieve market-thumping returns over the next 10-20 years. Reporting season (i.e. right now) is arguably the best time of the year to find hidden gems and put money to work. Later this week, I’ll be putting more of my cash to work in our most recent #1 stock idea for Rask Invest. To learn more about Rask Invest, click here.

[ls_content_block id=”695″ para=”paragraphs”]

Stock disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned. Rask Invest Analyst Cathryn owns shares of Afterpay.