Everyone knows the size of the global ETF industry is racing upwards, and a lot of its growth is at the expense of actively managed funds, but could it be getting out of hand?

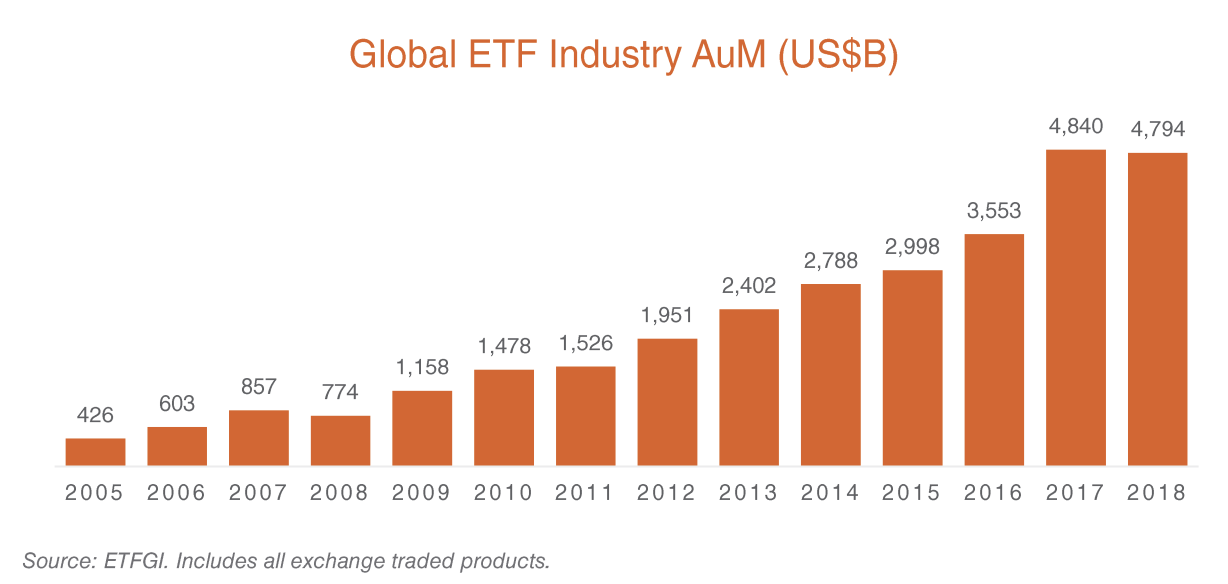

According to the first edition of BetaShares’ Global ETF Review, which cites data from Bloomberg and ETFGI, the global ETF market sits comfortably at $US4.8 trillion, having experienced 20% compound growth since 2005.

While 2018 appears to have been a backwards year for ETFs, consider that financial markets experienced a meaningful pullback in late 2018 and flows into US index fund ETFs and passively managed funds was over $US400 million. It was a near perfect — but opposite — result for the actively managed counterparts.

Index & ETFs Issuers Cashing In

Index funds track indices, like the ASX 200 or S&P 500. Then there are ‘smart beta’ or ‘rules-based’ ETFs which track indices that are modified for things like low price-earnings ratios (P/E) or momentum (stocks rising faster than others from one year to the next). We’ve covered Rules-Based ETFs here.

According to ETFGI, there were some 7,657 ETFs listed globally at the end of 2018. As we know, here in Australia, we have nearly 200 ASX ETFs already listed. BestETFs expects Australia to come close to reaching 200 ETFs in 2019. We’ve been told by quite a few in the industry that many ETF issuers are expecting multiple new listings this year.

Naturally, the demand for both esoteric and vanilla ETFs has pushed demand for index providers like S&P, MSCI and others to produce new research and offer new products for the ETF market.

According to a 2018 interview conducted by BestETFs’ owner, The Rask Group, with Vanguard Australia’s Head of Corporate Affairs, Robin Bowerman, it’s believed as much as 18% of Australian shares are owned via passive index funds and ETFs. In the US, the number is believed to be as high as 40%!

Passive ETFs – An Easy Sell

It’s pretty easy to sell a new investor on the idea of passive or index investing.

Historical performances look great, but transparency is key. Indeed, despite the fact that most of us have heard the warning ‘past performance is not a reliable indicator of future performance’, reports from SPIVA researchers tell us that active investors do worse, on average.

Passive investing also tends to be low cost, which — rightly so — means more in the pocket of investors and not fund managers. As Tony Hansen of Sydney-based small-cap fund manager EGP Capital has shown, even Australian active fund managers can run their businesses with a management fee close to zero.

Finally, passive investing via ETFs is very simple. Just click buy in a brokerage account, let it go but revisit the allocations every so often. Robo advice businesses like Stockspot or Sixpark will take a fee if you use them to invest in ETFs, but they add academic rigour to their portfolio allocations so investors don’t have to — and they make tax easy.

Are Systemic Issues Brewing?

With literally trillions of dollars in ETFs and index funds, and hundreds of millions of dollars being added every year, are we creating serious, systemic risks to financial markets?

There are very smart people, like EGP Capital’s Tony Hansen, who believe there could be an “insidious risk” hidden in markets when/if passive investing reaches a saturation point of, say, 90% of investment markets.

“Price discovery” is a serious concern. In other words, will mindless buying of shares via ETFs and index funds accentuate an extraordinary sell-off in share markets? We think the answer is yes – it would likely make a sell-off worse. BUT, ETFs are unlikely to be the cause of a crash or pullback.

Usually, bull market parties end when leverage is added to portfolios and ordinary investors let their guard down by incorporating debt or synthetic derivative leverage into their strategies. There are leveraged ETFs, of course. So some sceptics might point to these as serious concerns.

But there is just a handful of leveraged ETFs in Australia. There are many more abroad. But these represent only a small piece of the ETF pie. Leverage might become a risk when it’s combined with highly illiquid underlying assets in ETF portfolios or when prices dislocate – or both!

That’s why we think the real risk to ETF issuers is liquidity. That is, when the prices of ETFs severely dislocate from the underlying prices of the investments. We believe, for all investors, the key is looking at the liquidity of the underlying assets. The underlying asset in a share ETF is shares. For a bond ETF, it is bonds.

In order from what’s typically least liquid to most liquid, we have ETFs investing in unlisted products (quite rare, but watch this space), bond ETFs, small-cap shares, blue-chip shares, currency ETFs and cash ETFs.

Clearly, there are lots to think about as we enter a new era of investing!